Overhead Rate Formula and Calculator

It does not arrive at a daily overhead rate. Rather, it uses the as-bid HOOH rate times the cost of work performed during the delay period to determine the overhead used. Using the information above, we have the following. $7,112,274 x 100% = $6,646,985 107%.

Overhead Allocation Predetermined Overhead Rate YouTube

If overhead costs are $245,000 and the cost of goods are $529,000, then the overhead recovery rate would be 47 percent ($245,000 / $529,000 = .4631 or 46.31 percent). To simplify, round up and use 1.5 as the rate to conclude the business must recover an additional 50 cents for every dollar of direct costs.

PPT Flexible Budgets and Overhead Analysis PowerPoint Presentation, free download ID4728955

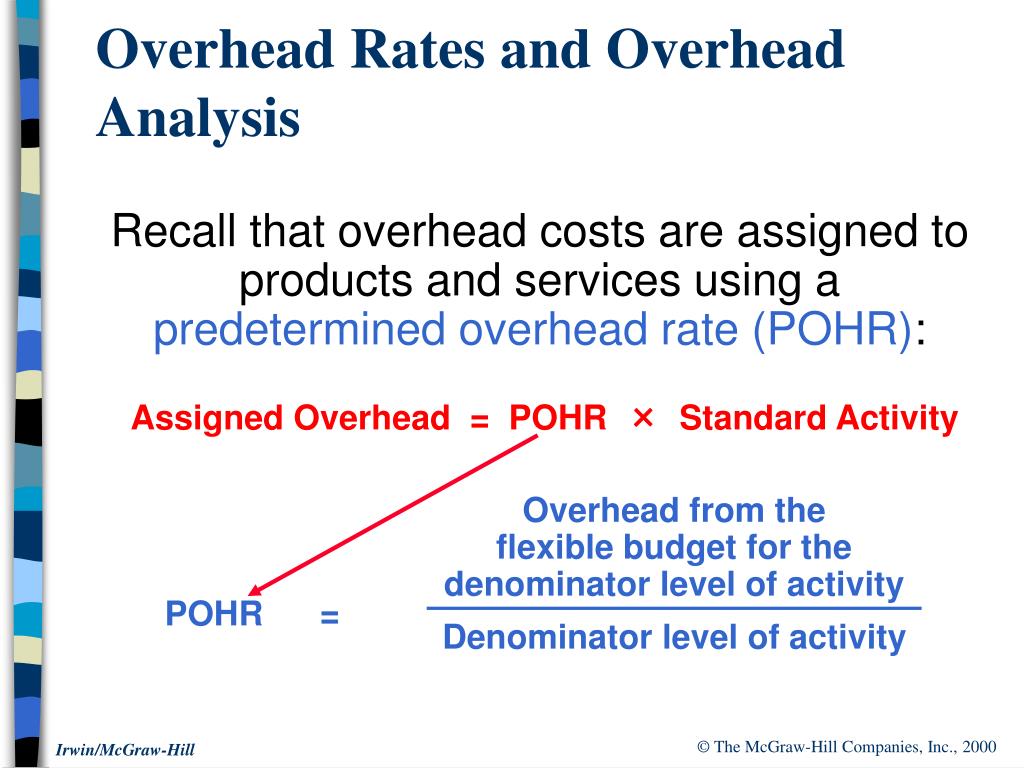

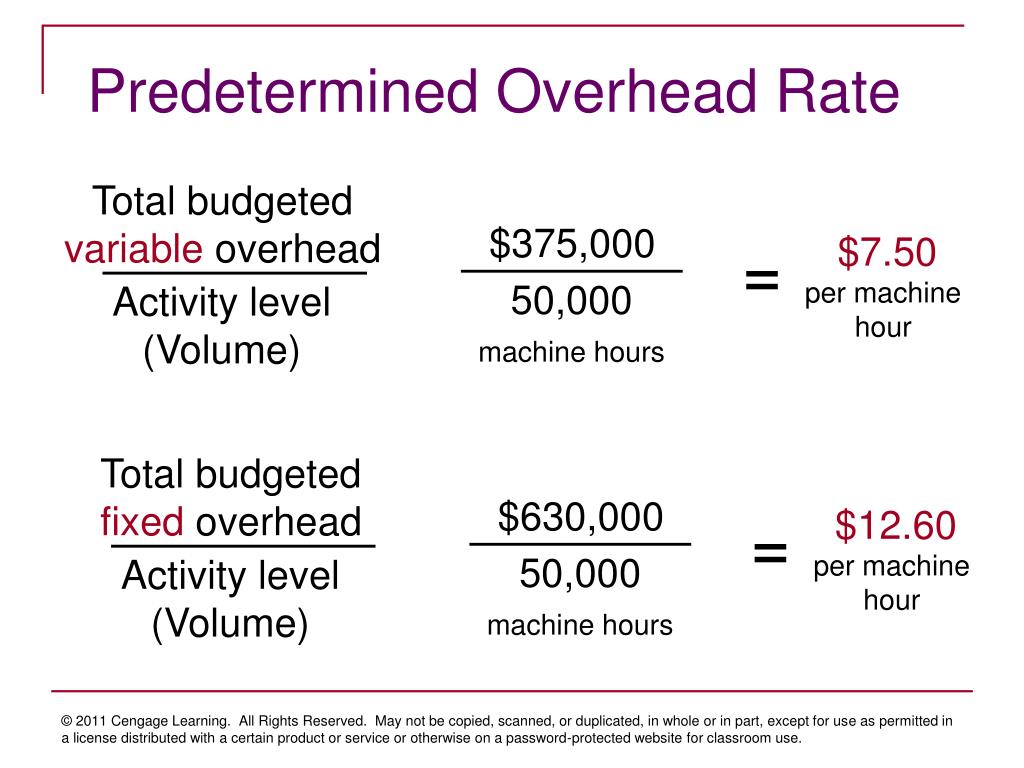

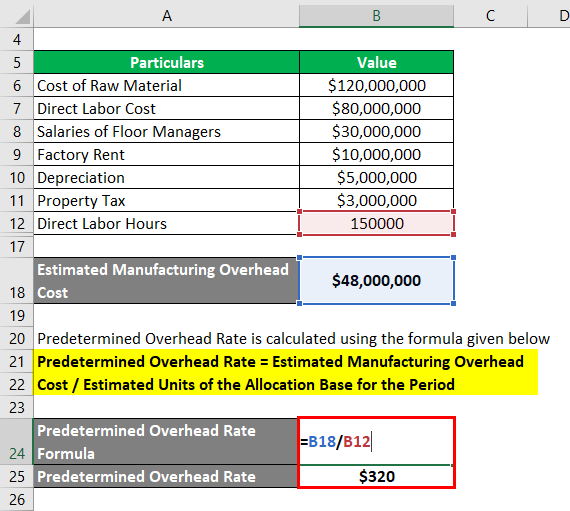

The overhead rate, sometimes called the standard overhead rate, is the cost a business allocates to production to get a more complete picture of product and service costs. The overhead.

PPT Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System PowerPoint

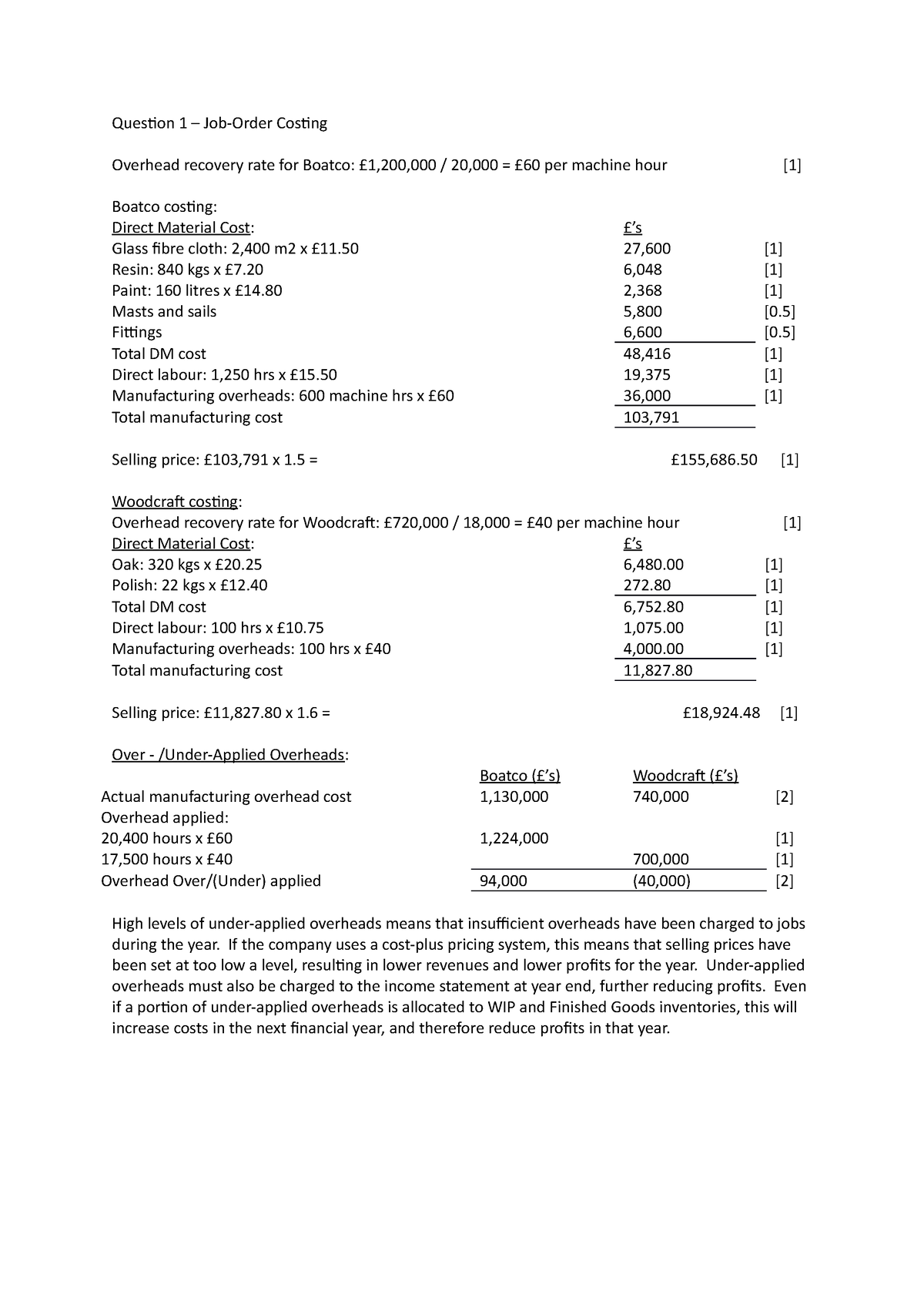

This is called the overhead absorption or recovery rate. Estimated overheads are absorbed into the cost of production, in order for money to be recovered from customers to pay the actual overheads. The rate is sometimes referred to as a recovery rate and sometimes an absorption rate, so it's important to realise that they're the same.

PPT Chapter 17 PowerPoint Presentation, free download ID6676007

"The labor cost overhead recovery method adds an estimated flat dollar amount to your labor rate to ensure your overhead is covered in your pricing," he says. "This method works well if you have a company with relatively consistent material, equipment or subcontracting requirements across different types of jobs."

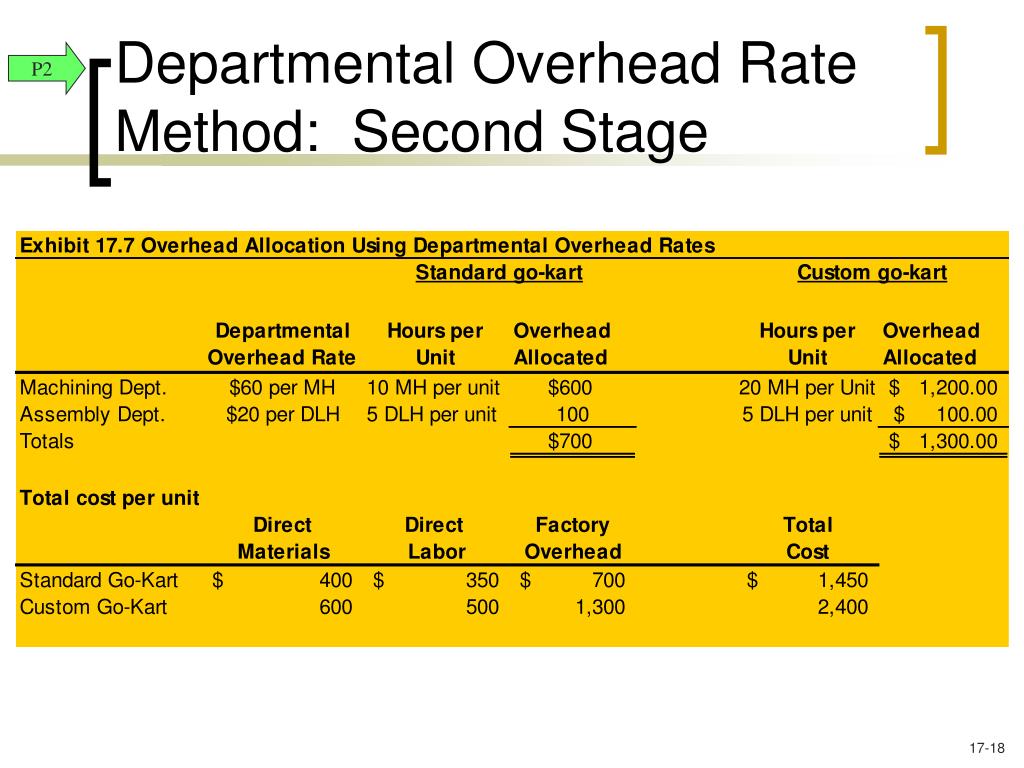

Overhead Cost Recovery Differential

What Are the Overhead Recovery Methods? The structure of the manufacturing process determines the method used to allocate indirect costs. The most common allocation methods are the number of direct labor hours and the number of machine hours used to produce a product.

Accounting for Overheads Allocation, Apportionment and Absorption rate AAT YouTube

"When pricing or bidding a job, it is necessary to figure that for every dollar spent on the cost of goods sold, an additional percentage must be added to recover the overhead or fixed operating expenses that cannot be included in the bid." Read the full article

PPT Chapter 3 Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing

The Overhead Rate represents the proportion of a company's revenue allocated to overhead costs, directly affecting its profit margins. How to Calculate Overhead Rate? Overhead costs represent the indirect expenses incurred by a company amidst its day-to-day operations.

Using ActivityBased Costing to Allocate Overhead Costs

Learn how to calculate overhead recovery rate with this easy-to-follow tutorial. This video will walk you through the steps to accurately calculate your over.

Overhead Recovery Rate Calculator Double Entry Bookkeeping

Overhead costs is recovered at a rate of $19.75 per labor hour ($320,000 ÷ 16,200), which when added to the $47.54 labor rate, results in a rate of $67.29 per hour. Tying overhead to equipment revenues can be done in a number of ways. For our purposes, let's calculate overhead cost recovery at a flat rate of $3.37 per machine hour ($320,000 ÷.

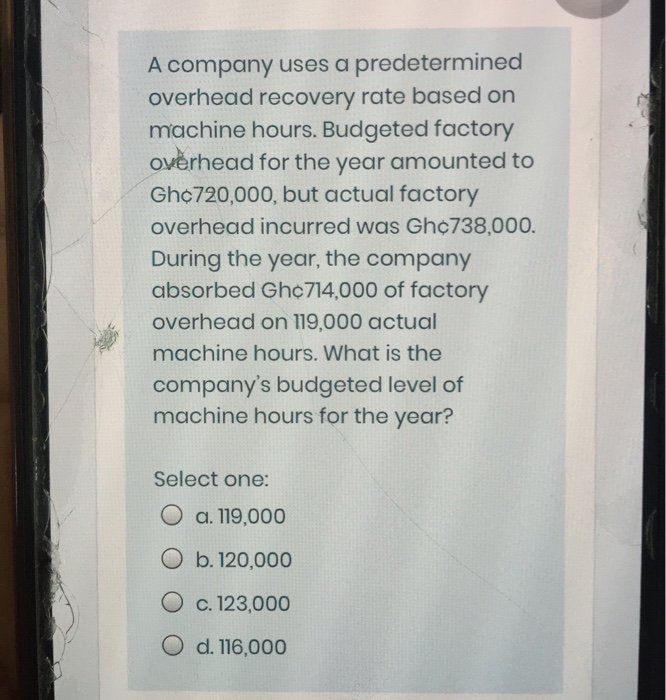

Solved A company uses a predetermined overhead recovery rate

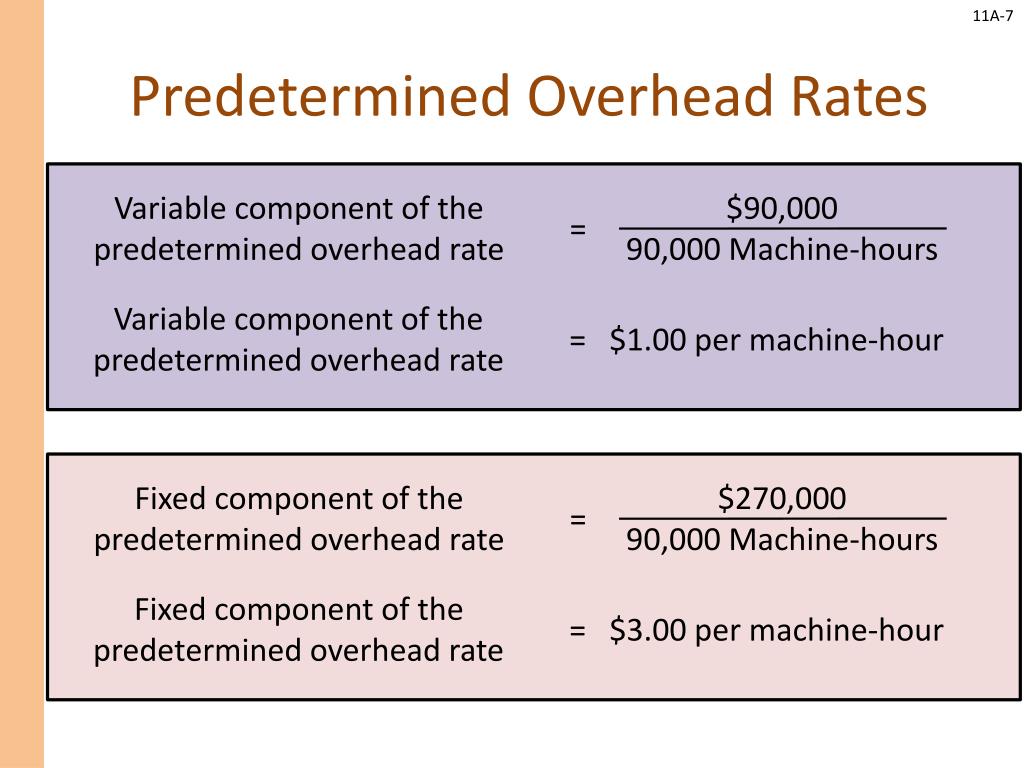

Predetermined Overhead Rate formula = 50000/10000 hours = $ 5/Labor hr. These are found using assumptions and are not accurate. The differences between the actual overhead and the estimated predetermined overhead are set and adjusted at every year-end. The adjusted overhead is known as over or under-recovery of overhead. Advantages

Overhead allocation calculator app EC&M

Overhead Recovery Rate in Construction: Understanding its Significance and Calculation. In the construction industry, managing costs is a crucial aspect of successful project execution and overall financial health. Overhead costs, also known as indirect costs, are essential for running the business but cannot be directly allocated to a specific.

Review Lecture answers Question 1 JobOrder Costing Overhead recovery rate for Boatco Studocu

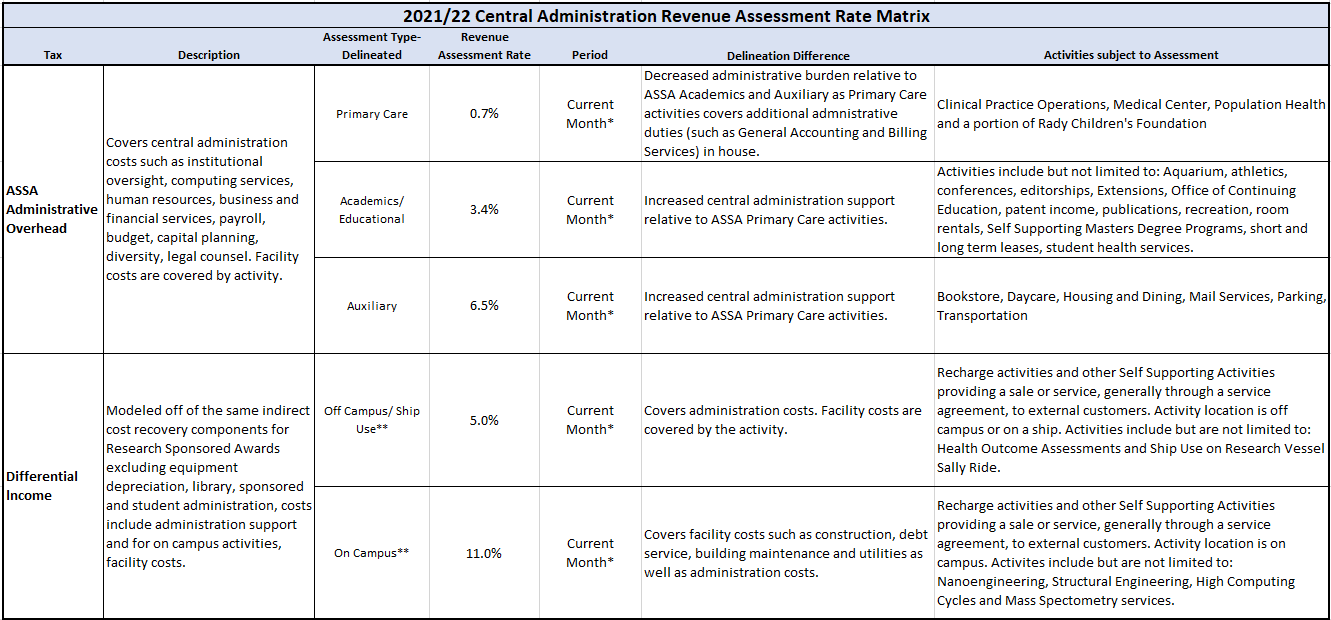

The overhead cost recovery rate, also referred to as Differential Income, is the rate applied to all sales to non-UC users of activities in order to recover the Indirect Costs related to the activity. Overview

Overhead Recovery Analysis Excel Spreadsheet Software Business Accounting

Specifically, the overhead recovery rate helps managers determine which fixed costs are not driven by volume or the number of goods sold. Figure out the total overhead costs for the organisation. Overhead costs are defined as those costs which are not directly associated with labour, such as salaried employees, utilities and rent.

Predetermined Overhead Rate Double Entry Bookkeeping

Overhead Recovery - this is the amount of overhead (company operating expenses) that you will recover on this project. We discussed three different methods of recovering overhead earlier in this course. 3. Net Profit - you need to price your jobs so that your business earns a profit. Build profit into your pricing plan so that you are planning

Predetermined Overhead Rate Formula Calculator (with Excel Template)

Hub Accounting April 18, 2023 Running a business requires a variety of expenses to create your product or service, but not all of them will directly contribute to generating revenue. These indirect costs needed to keep your business going are called overhead costs.